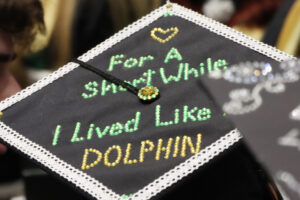

May was a month to celebrate: our faculty, the end of the academic year, and of course, the Class of 2025.

From an early age, Beck Wehrle, Ph.D., knew he wanted to pursue a life of inquiry and discovery. Wehrle’s teaching philosophy is rooted in inclusivity and curiosity, encouraging students to engage in thoughtful discussions and develop a lifelong love of learning. Passionate about mentoring undergraduates, he fosters an environment where students build confidence in science and explore the natural world with fresh perspectives.

Having studied Finance & Business Analytics at Le Moyne College, I currently work as a Private Wealth Advisor at Goldman Sachs, where I advise wealthy individuals and their families, as well as select foundations and endowments. While at Madden, I was selected for a summer internship with Goldman Sachs, which led to being hired full-time as a financial analyst.”

Read the Latest Edition of New Heights: the Magazine of Le Moyne College

Le Moyne is committed to working with all members of the media to develop stories on a wide range of topics related to our programs, students, faculty and other areas of interest at the College.